Corporate sustainability leaders have shared with us at our series of roundtables several challenges they are grappling with in working toward their aim of meeting company sustainability objectives and managing breakpoint change.

As they chase sometimes ambitious environmental, social, and governance (ESG) goals, including SCOPE GHG emissions reductions, one area they are examining as part of their current and future footprint is their vehicle fleet.

This makes a lot of sense. In terms of Scope 1 and Scope 2 emissions - those a company generates itself directly and indirectly - going electric can tick both boxes.

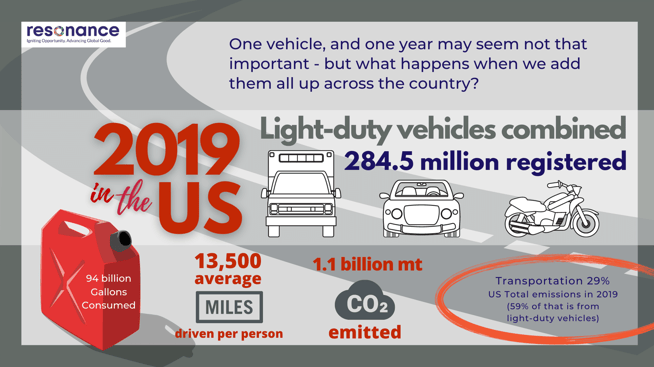

For context, in 2020, the world’s nations released a combined 34.81 billion metric tons of carbon dioxide emissions into the atmosphere. The transportation sector has been responsible for 14% of global GHG emissions. In the United States, that percentage is even higher (27% in 2020); of that, more than half (59%) is from light-duty vehicles, i.e., cars, vans, SUVs, and pick-up trucks.

Banishing Carbon From Supply Chains

Many corporations have accelerated bold targets for electrification aligned with sustainability commitments even in just the last two years, and fleet conversion to EV technology is one strategy toward that aim.

Although some large corporations own their own transport fleet, many lease, and that means company emission reductions targets rely on immediate action downstream in their supply chain by leasing agents and fleet management companies.

With typical fleet replacement every 3-4 years, many fleet management firms are being pushed to convert to EVs faster than they had ever thought possible, with some establishing targets of 30-40% of their fleet fully electrified by 2030.

According to the authors of a recent article in Reuters, large companies like AstraZeneca Plc (AZN.L) have announced their electrification targets. The drugmaker wants its global fleet of 17,500 vehicles to be fully electric by 2025 - and the company is pushing automakers to make those cars greener.

They also cite German agriculture and pharmaceuticals company Bayer (BAYGn.DE). It’s fleet accounts for under 5% of emissions; however, the company has set a target of converting 30% of its global fleet of 26,000 light-duty trucks, SUVs and sedans to EV within the next four years.

As more and more companies do the same, pressure is intensifying not only on fleet management companies, but also on the auto industry, to squeeze carbon and other pollutants out of their supply chains. This is promising through the lens of a collective, global "Net Zero" ambition.

However, electrifying large fleets as part of sustainability targets is easier said than done.

Challenges include not only the ability of suppliers downstream being able to meet EV production demands, but also market distribution barriers. For global corporations, some regions of the world don’t or won’t have EV or hybrids available for some time.

Additional deterrents to full conversion include EV affordability and performance, particularly when durable offroad EVs are required in certain terrain. For both public purchasers of EVs and companies with expansive fleets, there is still deficient public charging infrastructure, which poses challenges for drivers.

However, as more and more companies push for EV conversion to meet their sustainability targets, demand is working to accelerate innovative solutions and galvanized resources to address these challenges, with several broader economic benefits as well, including here in the United States.

Fueling America’s New “Battery” Belt In The US

In addition to corporate sustainability targets, significant cost reductions in renewable energy technologies, stricter government regulations, and economic policies that incentivize investments in cleaner energies are helping to accelerate the world’s transition to clean transportation.

As a result, we are seeing several significant needle-moving initiatives unveiled.

In October 2022, Honda announced it was collaborating with the South Korean company LG Energy Solution to build a $3.5 billion gigafactory in southern Ohio to manufacture lithium-ion (EV) batteries. Construction is scheduled to be completed by the end of 2024. The plan supports the company’s goal of phasing out the production of gas engines by 2040.

The Honda announcement is the latest signal that major automobile companies are scaling up investments in electric vehicles and EV technology in the U.S. Ultium Cells, a battery manufacturing partnership between General Motors and LG Energy Solution has two plants underway in Ohio and Tennessee, and earlier this year announced plans for a third location in Lansing, Michigan.

The Rise Of the Gigafactory

A “gigafactory” is a term that is used to describe a manufacturing facility designed for the largescale production of batteries for electric vehicles. Lithium-ion batteries are critical to the world’s clean energy future. EV batteries store energy in cells rather than generating energy by burning gasoline or diesel fuel through internal combustion engines.

Until recently, most gigafactories have been located in China, South Korea and Japan, which have been the world’s major suppliers of battery cells and EV components. In recent years, Europe has been making a serious bid to take some of the share of EV battery manufacturing away from Asia.

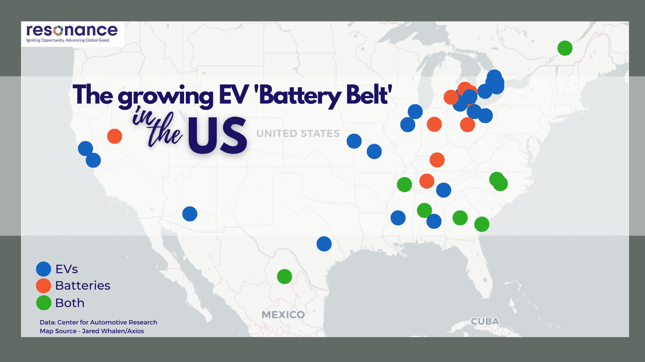

Source (Map): Jared Whalen/Axios

The U.S. has been slower to invest in EV technologies manufacturing. Tesla has been a pioneer in battery manufacturing in the U.S, building its first largescale battery plant in Nevada in 2015 in partnership with Panasonic. To date, Tesla has located three of its seven gigafactories in the U.S (in Nevada, New York and Texas). Giga Texas, which produces Model Y electric SUVs, has begun manufacturing their improved “4680 cells” to equip the SUVs.

A “Wave Of New Battery Investments”

Just as a microprocessor is the engine of the computer age, a lithium-ion battery is the engine of today’s electric car revolution.

For the revolution to succeed, cost-efficient, advanced EV batteries must be successfully mass produced.

Today, more than two dozen EV battery manufacturing sites are in the works in the U.S., concentrated in the Midwest and Southeast. And that number keeps growing.

More than a dozen are expected to be operational within the next five years.

Most are joint ventures between manufacturers and automakers, including Ford, Stellantis, Toyota, Hyundai, and Volkswagen. The new plants will create a domestic battery supply chain to support the shared commitment of the federal government and car manufacturers to electrify the nation’s fleet of automobiles.

Speaking at an event in Ohio mast month, U.S. Treasure Secretary Janet Yellen recognized the EV investments in the state and the effects it will have on green job creation and cleaner air: “Clean energy industries have been shown to create broad opportunity across the country, including in non-coastal areas and communities traditionally reliant on fossil fuel extraction.” Continuing, she said,

"Since January of last year, companies have announced over $100 billion in EV, battery, and charging investments here in America. …The wave of new battery investments in the Midwest has been so significant that some commentators are dubbing the region as the new 'Battery Belt.’”

Largest Investment In Clean Energy In US History

On August 16 of this year, the bipartisan Inflation Reduction Act was passed by Congress and signed into law by President Joe Biden. Among the provisions in the Act, was $369 billion in funding to address climate change and support a clean energy economy.

Included in this bill is support for the electric vehicle industry, including incentives for buyers of new and used EVs and credits for manufacturers to upgrade existing facilities and build new manufacturing capabilities.

The bill supports the federal government’s goal of cutting greenhouse gas levels in half from 2005 levels by 2030. It is the largest investment in energy in U.S. history.

The DOE also announced an additional $425 million in funding through its State Energy Program to support clean energy programs, including system-wide planning for grid expansion, modernization, and clean energy technology integration.

Driving Down The Costs of Clean Energy

Fueling the accelerating rise of electric vehicle manufacturing in the U.S. and around the world are an increase in affordability and improved technology, which is enhancing EV performance.

Lithium-ion battery costs have fallen more than 90 percent over the last 15 years, which positively affects the cost of electric vehicles, while new improvements in energy storage and technology continue to increase energy density and performance.

Recently in Nature, Penn State researchers announced a breakthrough in EV battery design that could result in a significantly reduced charge time (10 minutes) and a substantial increase in travel range. What all this means for Americans is an expansion of clean energy jobs, lowered carbon emission rates, and cleaner air.

Steering The Transition To Clean Energy

It is becoming obvious the reach coming from these innovations will extend well beyond U.S. borders. When it comes to carbon emissions history matters. Today’s levels of carbon dioxide in the atmosphere are cumulative, the result of human activity over the last 150 years.

Until 2006, the United States has been the highest producer of carbon dioxide emissions from burning fossil fuels—coal, natural gas, and petroleum—for electricity and heart production, industry, and transportation. That year, China surpassed it due to rapid industrialization. The two countries remain the top producers of greenhouse gases followed by India, Russia and Japan.

As the U.S. and other top GHG producers make a transformative commitment to renewable energies, the launch of a clean energy global economy may finally be underway.

In many ways, corporate sustainability objectives and targets, particularly related to fleet conversion upstream and downstream across supply chains, is a major influence in steering the transition to clean energy through investments in EV technology. Ultimately, this may prove to be one of many strategies driving solutions to wicked problems like climate change.