-

What We Do

-

Areas of Expertise

Who We Work With

-

-

About Us

-

About Us

Find out what differentiates us from other firms and how we can support your needs.

-

-

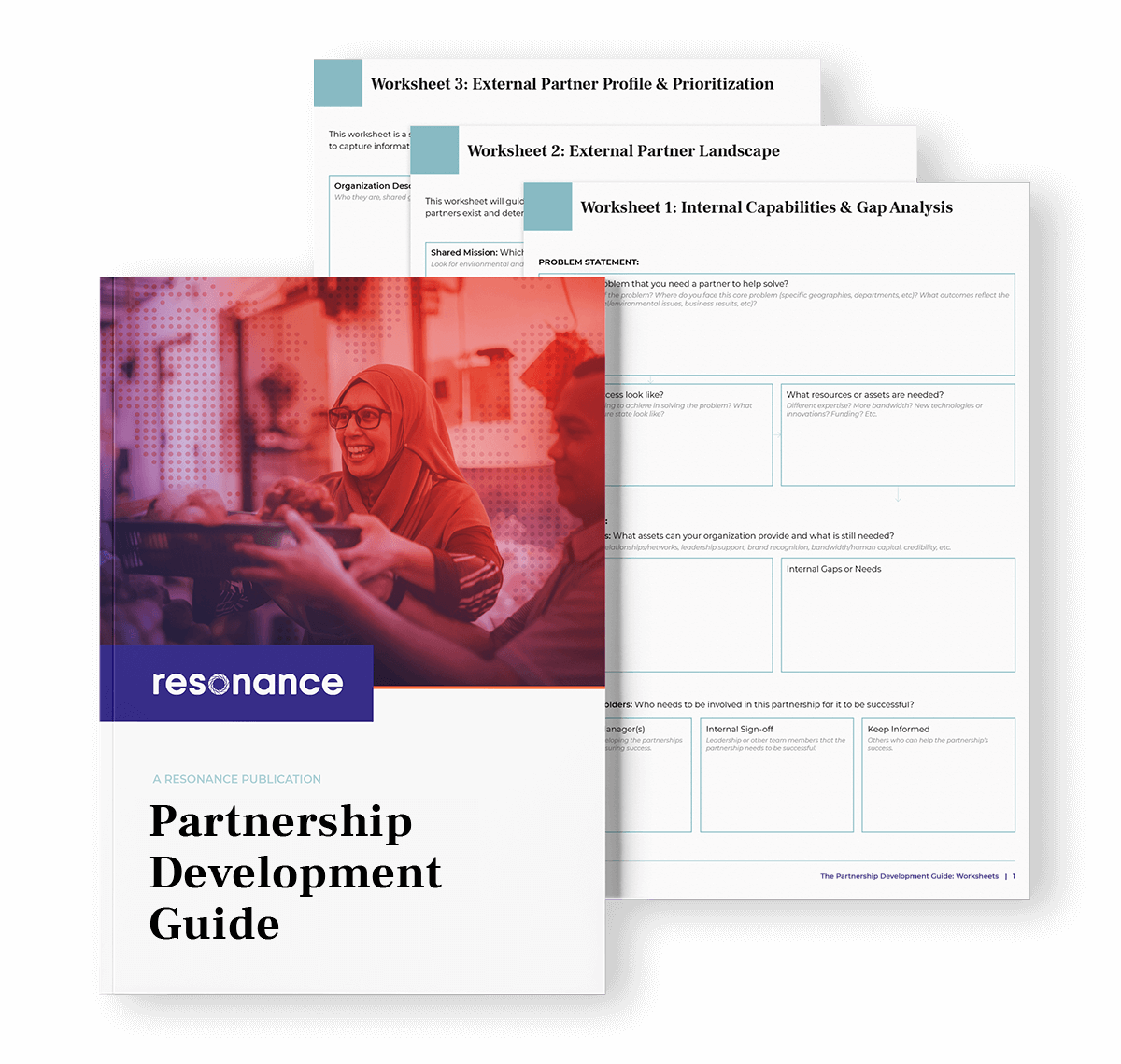

Resources

-

Resources

Articles and impact stories highlighting best practices and new ideas in social and environmental impact work

-

- Contact Us

.png)