For companies operating in emerging markets, securing their supply chains while meeting sustainability goals has never been more important. It’s also never been more challenging: It’ll take ambition, innovation, and commitment to take on pervasive supply chain risks linked to climate change, water scarcity, soil erosion, modern-day slavery, deforestation, and inadequate infrastructure. It’ll also demand significant resources.

In short: Partnership will be key. Here, we focus on one valuable partner type: Development finance institutions (DFIs).

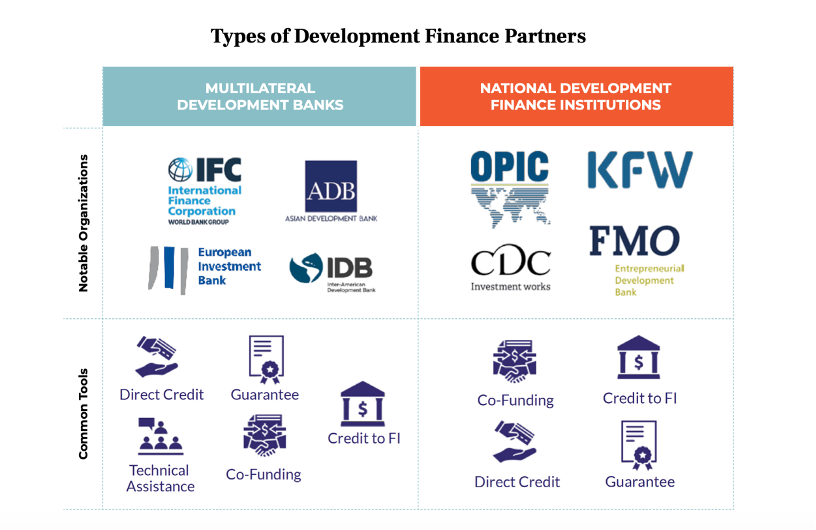

For many companies, partnerships with DFIs hold tremendous promise. DFIs are specialized development banks that support private sector development in emerging markets. They’re often backed by governments or benefit from government guarantees. This helps them offer financing with competitive terms.

Different DFIs have different geographic focus areas, or they focus on particular industries, such as energy, agriculture, telecommunications, or apparel. DFIs can offer companies relatively patient capital and a higher risk tolerance than most traditional investors (since DFIs are designed to go into countries or markets that many other private investors won’t).

A finance partnership with a DFI can help a company address global supply chain risks or incentivize suppliers to make sustainability improvements or adopt new sustainable practices.

5 Tips to Partner with a Development Finance Institution (DFI)

Partnering with a DFI and finding the right project or program can take time, patience, a fair bit of homework, and a lot of persistence. While the reward is big, far too many companies come up short.

To help teams succeed where others have been derailed, we’ve pulled together 5 key partnership tips, to improve company collaboration with DFIs.

1. Understand the Problem on the Ground First

Before a DFI will sign onto a deal, they want to know a company has done some initial research, mapping, or feasibility reports to understand what’s happening on the ground and how it’s affecting their supply chain.

Sustainability managers need to answer questions like: why does your company need financing? What problem or issue in the supply chain (or elsewhere) will this financing help you solve? What’s the program or solution you’re putting forward? Who are your local partners? What behavior on the ground are you trying to incentivize?

As a starting step, engage your field teams, suppliers, and/or other local partners to strengthen your understanding of the problem and possible solutions.

2. Think of Financing as the Tool, Not the Solution

Financing can be a powerful mechanism to help incentivize sustainable practices and change behaviors across the supply chain. But it must be used appropriately and strategically. If your understanding of the problem—and the root causes driving it—is flawed, you risk pulling the wrong levers when you deploy finance. Yet, if you engage local partners and an inclusive design process, you’re more likely to design a solution that addresses practical realities on the ground. In this context, you can deploy finance with greater precision and greater results.

In short: Finance is not a replacement for sound solution design—but it can be a powerful tool when informed by inclusive design and strong ecosystem partnerships.

3. Consider Whether a DFI Partnership Is Right for You

There are several ways to determine whether or not a DFI partnership is right for your company. If a company needs cheap and fast capital, it may be better off partnering with local market actors and traditional financing providers. But if a company is looking for a partner for risky, volatile climates, then a DFI is worth considering.

If the target country has a recession, a DFI is more likely to help a company navigate the downturns and unforeseen events. A DFI has broader goals than just extracting a return on investment, so it may be more willing—and able—to alter payment terms and repayment periods when conditions get tough.

4. Choose the Right DFI

Before reaching out to a DFI, spend time researching and understanding their needs and requirements. Not all DFIs are the same. DFIs are absolutely hunting for deals, but each has its own priorities and mandates that will drive its investment decisions.

As political organizations, DFIs have specific priorities and constraints they must operate within. For example, the U.S. Development Finance Corporation (formerly OPIC) offers debt financing in the form of direct loans and loan guarantees to support medium- to long-term investment projects in emerging markets. Loans are typically 3-15 years. All investment projects must support respect for the environment, workers’ rights, human rights, and local communities. Meanwhile, the IFC requires multinationals to be investment grade (or close) and use an environmental management system to monitor suppliers.

5. Be Patient

Deals can take a long time to close and have multiple steps. Before a company can talk about financing and structuring a deal, they’ll have to have a planned project and validated concept. They’ll have to know their local partners and have all their “ducks in a row,” including knowing how much financing they need from the DFI. The internal process at a company may take 6-12 months, and structuring a deal with a DFI can take another 3-6 months—and that’s in a best-case scenario, assuming the company has provided all the required information to the DFI. More complex deals can take even longer, up to a year or more. DFI partnerships aren’t rapid response, however they can offer significant shared value once the program or project is kick-started.

Create High-Impact Partnerships with DFIs

To advance sustainable supply chains and grow their impact in emerging markets, companies need to develop partnerships across the ecosystem: They need to collaborate with their suppliers and other industry players; they need local partners with networks and know-how on the ground; and they need, often, to collaborate with global development actors who can offer valuable networks and technical expertise to take on complex problems in challenging contexts.

And, of course, they need finance. Here, we’ve focused on the promise and particularities of company partnerships with development finance institutions (DFIs). The tips outlined above will help companies build strong partnerships with DFIs.

Companies interested in DFI partnerships should get in touch with a sustainable impact expert to discuss opportunities to unlock market access and advance sustainable impact in emerging markets.

Want to learn more? Check out the Financing Sustainable Supply Chains white paper to discover how multinational companies can leverage development finance institutions to meet corporate sustainability and business goals.

Editor’s Note: This post was originally published in April 2020, and has been updated for accuracy and current best practices.